In today’s high-stakes financial environment, private equity companies must find, assess, and execute investment opportunities faster than before. Whether competing for enticing transactions or doing a comprehensive business study into possible acquisitions, great research is the key to competitive advantage. Apex Group and Forrester Consulting say PE firms that outsource data/ research and operations tasks can save $3.9 M in house team members’ costs for almost three years, equivalent to four to five years of full-time hires per fund. Given the unpredictable nature of transaction pipelines, developing and maintaining a thorough in-house research staff is expensive and inefficient for many organizations, especially growth-focused or mid-market players.

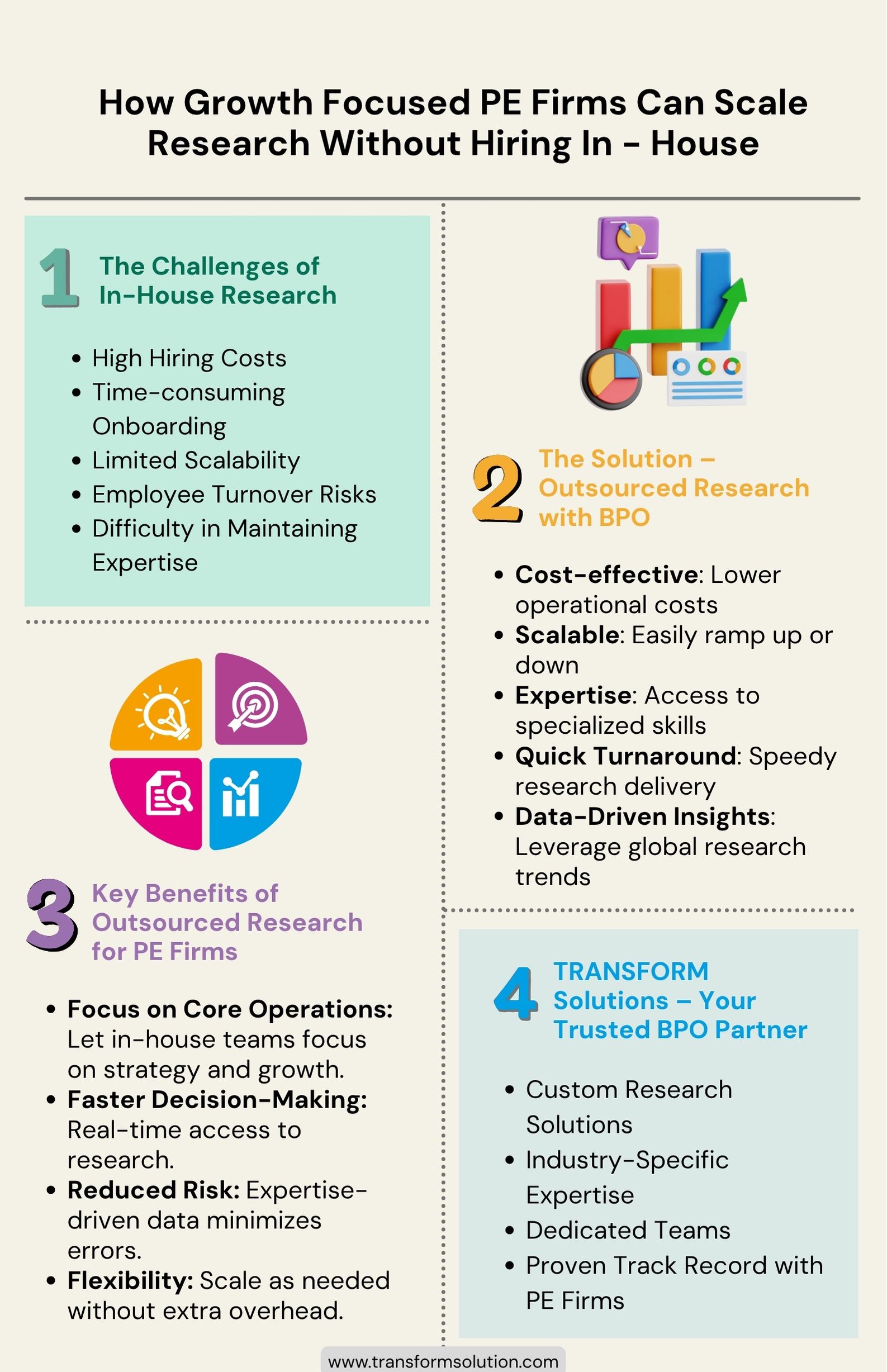

Every partner must decide: how can a private equity company increase research capability without hiring a huge, fixed-cost team? Outsourcing becomes more important. PE companies may quickly access extensive industry expertise, skilled financial analysis, and strong data-driven insights from specialist private equity research providers without the expense or delays of recruiting permanent analysts.

Through outsourced research partners like TRANSFORM Solution, organizations may receive high-quality materials targeted to their strategy. Market research, competitive benchmarking, financial planning, and analysis let growth-minded investors act swiftly, decisively, and confidently in difficult markets. This blog explains why private equity companies should outsource research to scale smarter and remain ahead, for more than simply cost savings.

Research determines the difference between high profits and costly blunders in private equity companies’ tough competition. Every successful acquisition needs detailed examination of businesses, markets, and financials, which takes time, expertise, and modern technologies.

Traditional due diligence vetting of financial statements and legal compliance is insufficient. Complex private equity services must analyze financial data and multi-year trend evaluations to comprehend a target’s revenue, margins, and cash flows. With over 75% of PE firms now formally evaluating a target’s scalability before investing, outsourced research has become a strategic lever for smarter, faster decisions. They must also consider customer behavior, supply chain weaknesses, and geopolitics. PE companies may model different scenarios to correctly gauge a company’s performance and predict future risks and possibilities by hiring financial planning and analysis professionals.

Target value depends on the market and industry. Market research, along with industry mapping, is essential here. PE investors must watch macroeconomic, competitive, and regulatory developments in energy, healthcare, technology, and manufacturing. Firms can avoid overpaying for sector-sensitive assets by examining these criteria. In addition, extensive firm research on supply chain positioning, client concentrations, and technology advantages helps determine durable competitive advantages.

Competitive benchmarking lets investors evaluate a possible purchase against industry peers on EBITDA margins, revenue growth, asset turnover, and market share. A thorough understanding of competitive benchmarking and how to execute it ensures organizations not only use data but also analyze it properly. Investors can accurately price agreements, find operational improvements, and identify industry leaders and laggards using comparative data.

Despite its importance, many private equity companies struggle to develop internal research departments. Using in-house personnel is rarely the best solution for organizations focused on ROI and agility due to recruiting issues, cyclical workloads, and the requirement for diversified skills.

Finding analysts who can perform detailed financial statement analysis, complicated modeling, and industry evaluations is time-consuming and expensive. Base compensation for senior PE research analysts in the U.S. often exceeds $150,000 annually, excluding bonuses and benefits. Experienced professionals’ salaries, perks, and incentives have increased as top 10 private equity companies and bulge-bracket investment banks fight for personnel. Even after hiring, corporations pay for professional development, software licensing, and performance management. These fees sometimes drain growth-focused PE firms’ resources from investments.

Private equity deal pipelines vary. When busy, in-house teams might get overloaded, causing bottlenecks and hasty analysis. Staff may be underused in calmer times, with employers paying for unworked hours. According to McKinsey, smaller PE firms employ 22–30 people per $1B AUM, while larger firms with $50B+ AUM employ nearly the same, just 8 per $1B, showing diminishing returns on scale. Permanent research manpower is wasteful for flexible organizations due to this mismatch. Private equity firms may expand capacity to meet transaction volume by outsourcing research and paying just for what they need.

A purchase of cloud software one month and a consumer products business the next must be evaluated against quite different industry benchmarks and competitive environments. Hiring experts from every relevant industry is too expensive. Generalist analysts may ignore dangers and provide shallow insights. Whether the acquisition includes a healthcare provider, renewable energy business, or fintech platform, a research partner with different industry expertise provides comprehensive, actionable knowledge.

Outsourcing research to specialists is becoming more popular among private equity organizations. This strategy boosts capabilities, speeds decision-making, and provides deep, precise insights, not only cuts costs.

Research outsourcing lets organizations adjust capacity instantly. Outsourced teams can handle several prospects or one high-value opportunity. Firms navigating unpredictable marketplaces or seizing unforeseen opportunities benefit from this flexibility. It guarantees they never miss a transaction due to excessive research team workload or squander money when deal flow slows.

Most PE companies cannot afford to create domain-specific expertise and tools like those provided by established research suppliers. Exclusive databases, premium financial reporting and statement analysis tools, and established frameworks for evaluating financial statements and operational KPIs are included. Results: quicker, more accurate evaluations that help corporations decide on appealing prospects.

Top suppliers bundle market research, competitive benchmarking, and financial analysis. They combine qualitative insights from consumer interviews, supplier feedback, and expert comments with quantitative data from financial sheets and industry studies. This comprehensive strategy helps organizations assess market barriers and growth drivers before investing.

Today, investment research is completely transformed via digital technologies/strategies. Now, deeper and more accurate insights can be recognized in Private equity services, hazards sooner, and can distribute results easier and faster with the help of various automation platforms/ tools, advanced analytics tools, and data visualization dashboards, which allow analysts to focus on strategy, planning, and easy/ faster execution.

It’s crucial to study timely data nowadays. Because of RPA and AI — AI-automation solutions, scraping financial filings by modern providers has become easier, measuring KPIs across hundreds of organizations, and watching industry latest updates/ news for pertinent events. Research teams can now save days/ weeks of hard work/ tedious effort by expediting data collection, decreasing expenses, and reducing human errors.

Highly advanced analytics solutions analyze large data sets from various sources, for example, analysis of the financial market, reports of earnings, macroeconomic indicators, and realistic/ real-time industry trends. These cases, scenarios, and projections that can be predicted can help PE firms understand how their business is heading today and where it may go in the future under different market scenarios.

Dynamic dashboards from top research partners simplify difficult results. These tools help partners and investment teams swiftly examine data, verify assumptions, and develop consensus for financial planning and analysis, financial statement analysis, and competitive benchmarking. Dashboards that are shareable can accelerate investment by transferring information from research team members to decision-makers smoothly.

In the ultra-rivalry private equity era, even the best ideas and strategies might not work without comprehensive, timely research practice. Outsourcing/ offshoring tasks provides private equity organizations a competitive edge by combining skills, knowledge, technology, and adaptable resources.

In this era of fast-paced marketplaces, speed matters. Companies can perform efficiently in diligence due to outsourced research and make competitive bids or reject dangerous offers before competitors act. For auctions and rapid market changes, one needs agility that can provide PE partners confidence that every decision is supported by rigorous, up-to-date research.

Outsourced research staff members can help get context-rich assessments of a position of target market, competitive Threat, and Strategic Decisions. They can help get a clear idea of operational and revenue development probabilities and can help gain clarity on post-acquisition value generation roadmaps. Companies can recognize risks and opportunities better by unlocking deeper insights by merging financial analysis and market intelligence.

Outsourcing research lets partners, principals, and senior management focus on what they do best: building relationships, structuring unique transactions, negotiating advantageous terms, and mentoring portfolio firms. Firms boost efficiency where it matters by outsourcing financial data analysis, business research, and industry mapping.

Every excellent investing concept relies on research. However, developing and keeping a big, permanent in-house staff for modern private equity research wastes resources and inhibits adaptability. However, outsourcing provides scaled knowledge, cutting-edge technologies, and flexible capacity to help private equity companies move decisively, assess carefully, and focus on maximizing profits. TRANSFORM Solution redefines research support by combining human experience with automation and sophisticated analytics to provide financial analysis, competitive benchmarking, market research, and more. Growth-focused investors want a lean, scalable private equity research process that uses the finest external partners to understand, quantify, and data-drive every opportunity, risk, and decision.

Trust TRANSFORM Solutions to be your partner in operational transformation.

Book a free consutation